As interest rates rise to temper inflation, banks and consumers are feeling the changing economy's effects and potential of a recession.

Bad Moon on the Rise?

As the Federal Reserve Bank increases interest rates to temper inflation, there are already tell-tale signs indicating banks and consumers are feeling the economy's effects, especially higher-risk borrowers.

Worrying Credit Trends

Historically, most subprime borrowers with credit scores under 620 have had to depend largely on non-traditional lenders for credit. In some cases, traditional lenders will extend credit, yet at a higher price. According to Equifax, this segment is beginning to fall behind on payments for car loans, personal loans, and credit cards faster than economists had expected only a few months ago. Delinquency within subprime car loans hit a 15-year high in February of this year with 8.5% of loans 60 days past due or more. Credit cards and other personal loans – generally the last loans to be paid by consumers facing financial issues - are even worse, with 60-day delinquencies up over 11%. As rates move higher, this will only exacerbate the issue.

Both Capital One and Credit One Bank, which have substantial exposure to sub-prime issuers, reported higher delinquency rates in the first quarter than their large bank issuing peers. Meanwhile, the CEOs of both Wells and Capital One have recently commented on the extraordinarily strong credit environment over the past few years while also warning of expected deterioration in consumers’ ability to pay leading to higher delinquency projections and charge-off rates in the future.

Risks for Lenders

On the other side of the ledger, borrowing by U.S. Banks has increased by $840 billion since late 2019 per Bankregdata.com. During that same period, delinquencies decreased by $13.7 billion, and charge-offs fell by $7.4 billion. Much can be attributed to government stimulus programs, which increased personal savings by $2.7 trillion between the beginning of 2020 and the end of 2021. But, in February, personal savings rates dropped to 6.3%, lower than the 10-year average before the pandemic, per the Wall Street Journal's Dion Rabouin, and consumers increased their borrowing by $42 billion in the same month. Specifically, credit card balances at the largest issuers increased by 20% in the first quarter over the fourth quarter of 2021 with total credit card debt hitting an all-time high of $930 billion, surpassing the $870 billion peak in 2008, per the Federal Reserve Bank of New York. During this same period, the Bureau of Labor Statistics shows the average workers' pay increased by 5.6%, but with inflation running at 8.3%, real income growth is negative 2.7%.

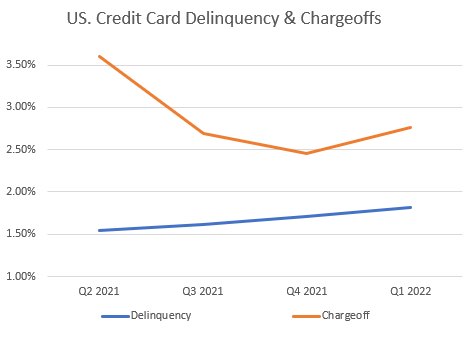

As borrowers increase the amount of debt they take on, and the Federal Reserve raises interest rates, the balancing act will be for delinquencies not to bleed over into higher-quality credit customers. In aggregate, delinquency rates for credit cards have risen from 1.48% to 1.73% over the last four quarters. A worrying trend is while transitions into delinquency among all credit card borrowers have risen sharply, this has been especially true among younger borrowers according to the New York Fed.

Moves to Make

As rates rise, so will interest income for banks as they reprice revolving loans and boost rates on new fixed-rate offerings. However, it appears unlikely improving margins will be enough to offset the increased losses on the horizon especially more marginal credits. Which clients, product portfolios, and segments will take the biggest hits are still in question. Lenders are already increasing reserves, reducing line exposure, and tightening underwriting standards. While this may help individual lenders in the short run, the overall credit tightening will further squeeze customers, limit borrowing, put a damper on economic activity, and potentially boost the severity of the coming recession.

In addition to taking steps to mitigate portfolio risk, issuers should also continue to focus on identifying revenue lift opportunities in their lending book not tied to margin improvements. Profit Insight’s 50-year history has proven a critical examination of a bank’s portfolio can yield tangible and measurable opportunities to enhance revenue, reduce costs and improve processes. Especially with the challenges posed by the market today, it can be hard to dedicate resources and know where to look to uncover the benefit. But working with a dedicated and experienced partner like Profit Insight can drive earnings lift to offset some of the financial challenges to come.