Gathering, curating, and effectively leveraging the huge amounts of data available to banks and card issuers may be THE critical issue of this decade. Banks have long based their business on managing large amounts of information, but Big Data has gotten much bigger and legacy systems are ill-equipped to handle the volume or provide access to those who need it.

The Challenge

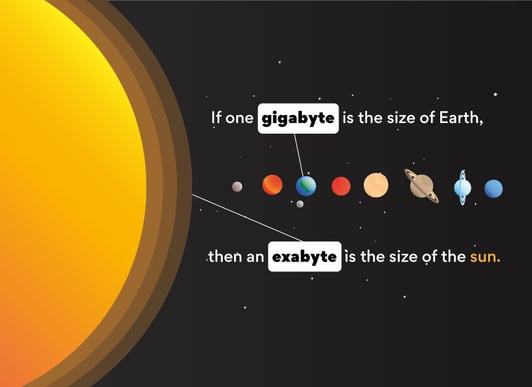

The magnitude and scale of the data challenge is hard to fathom but Forbes recently estimated over 2.5 quintillion bytes of data are created each day. One billion gigabytes is equal to one quintillion bytes or one exabyte. So, how large is an exabyte — quite simply it’s big, really big.

This graphic offers some perspective:

But the challenge isn't simply with the sheer amount of data, the second issue is that the data isn't well-organized. The information that banks have likely resides in multiple systems, some owned and controlled by the bank and others by the vendors who provide services to support the bank's infrastructure and products.

Ideally, the ability to narrow down to a single view of data for the end users is what matters, as simplicity leads to ease of use. Real-time access to data to provide stakeholders with a more complete picture and, therefore, the ability to make better informed decisions for the customer and issuer. Meanwhile banks not only have to address business, regulatory and legal issues but also need the capability to monitor and access unstructured data including from social media and other outside sources to manage reputational risk.

The Benefits

There are huge front-office, back office and human resource benefits to incorporating Big Data across banking organizations.

Customer Experience

Customers have become expectant of a high level of service, customized to their financial needs. They expect single sign-on and verification information to be passed to call center representatives. Customers also expect anyone they come in contact with at the bank to have an understanding of their entire relationship. Banks need to utilize the personal and account information as well as the channel and transaction history of their clients to drive better segmentation and to create timely, relevant offers and hyper-focused products.

Operations

Better and more timely access to data can and should improve the predictive power of risk models; leading to more accurate and efficient loan originations and credit management as well as provide earlier detection of fraud through the use of AI and other machine learning tools. Operationalizing the use of data across the organization should generate more informed decisions in Call Centers, reduce the use of manual processes and automate the review and management of sales and financial goals.

Employee Engagement

A less obvious but high potential use of data should be its application to employee engagement. Organizations should be able to drive improved performance by identifying and encouraging top performers, monitoring and driving cooperation between different departments and supporting overall morale with incentives in real-time as opposed to waiting for annual or quarterly reviews.

How to Get There

In its 2020 Banking and Capital Markets Outlook, Deloitte noted the multiple challenges banks face with outdated legacy systems create a huge roadblock on the path to transforming data and technology. Their recommendation is for banks to address the data challenges first before focusing on technology transformation.

One of Profit Insight’s global business partners, ThoughtSpot, has reached the top of both the Gartner Magic Quadrant and Forbes’ list of the top data analytics and BI platforms in the marketplace in just a few short years. ThoughtSpot has built a comprehensive analytics suite that allows any user, from C-suite executives to front-line employees, to query billions of rows of data in natural language and leverage artificial intelligence to autonomously generate feeds providing real-time insights into what is going on with their data.

Right now, banks and card issuers should find a partner, such as Profit Insight, to help them address the immediate need of leveraging available data to drive internal performance and meet the needs of their customers.