Community banks and credit unions play a critical role in the success of the markets they serve. So how to thrive in the coming months?

Ready to Thrive – NOW

Community banks and credit unions play a critical role in the success of the markets they serve, something that proved itself over the last 15 months. Community banks were critical to helping those impacted by job loss during the pandemic and instrumental in processing and granting of the PPP loans businesses needed to survive. As the economy pushes forward, deposits are high, and driving profitable growth while re-engaging customers is vital to future outlooks. Costs may have grown due to continued expenses associated with quickly adjusting to a remote and virtual environment for customers and employees alike while retaining rigor on compliance and regulatory affairs. More and more investment was needed in technology ranging from cybersecurity to staying relevant with digital offerings at a pace that won’t slow down.

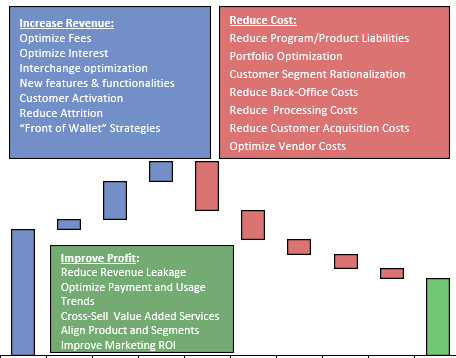

So how to thrive in the coming months? Our experience at Profit Insight suggests there are always opportunities for revenue or cost improvement. The hard part is finding them, and unfortunately, what is evident in one institution may be different in another. But, with attention, it is certain that opportunities can be discovered.

Start At The Top. In general, the biggest opportunities may be found with the biggest contributors to non-interest income. Current consumer account activities differ from what we saw pre-pandemic; spending is down, savings are up and stimulus packages require a host of elements to provide the much-needed benefits. Understanding how key account performance activities come together is important from thresholds and process exceptions to product mix and profitability. Generally, benchmark intelligence may tell you some, but not all competitive practices, and the tradeoffs need to be understood to evaluate future changes as well as back-test recent ones.

Manage Your Success. Many community banks and credit unions still offer some type of free or reduced fee checking as a core strategy. Unmanaged, it can cost you money. Banks should examine overall performance including acquisition and attrition rates, and how they impact churn and net new account growth. With essentially no barriers to entry for various deposit products, you may find many shell accounts opened just to receive a bonus or sales incentive, to avoid a non-customer fee, or other similar reasons. These accounts likely incur expenses including incentives, statement production costs, monthly charges from your processor, etc. Focus on what is being acquired and work diligently to onboard and activate. This will not only reduce some costs in the short run but should provide interchange income and the opportunity for future sales to emerging financial service needs.

Enlist Support. It is difficult to look across an organization and throughout the varying levels without the assistance of numerous people. Some of the best ideas come from those closest to the opportunity, though currently they may not be motivated or have the resources and time needed to introduce change. One practice we have seen in some organizations is a simple Kaizen approach focused on small but frequent improvements. These are not one-time events but rather are attempts to create a culture of change embracing innovative approaches to enhancing the customer experience. Through sponsorship, communication and reinforcement, ideas having meaningful impact can evolve from the across the workforce, resulting in substantial cost savings and growth opportunities for the company.

Avoid Losses In Income Categories. Sounds like a no-brainer, but often good decisions were made in past times that no longer reflect the reality of today. As an example, we find clients who provide some type of ‘free’ benefit to all new accounts. For many reasons, this is not necessarily a smart tactic. Since only 60-70% will actually use the benefit, the other 30-40% can represent a hard expense to the institution.

Leverage Shared Expenses. Technology plays a major role in today’s banking sector and community banks and credit unions regularly face challenges to remain relevant in this space and meet their customer’s expectations. On-going maintenance and security concerns regarding technology are large expense items eating away at potential revenue. Therefore, outsourcing technology needs can drastically reduce these costs by sharing those expenses across all banks utilizing the specific technology; not to mention a reduction in overhead costs. Selecting the right partner who can meet the changing demands of your environment becomes essential to long-term results.

Find The Rogues and Be Surprised. In the quest for business, it is often necessary to waive service charges, customize pricing, or grant rate premiums. Many assume areas such as free checks and other account perks are just a necessary requirement. Digging deeper into specific results such as approved/declined transactions, cash limits, configuration, and the like often reveals new opportunities. Back offices are filled with manual interventions which can be risky and result in lost revenue potential. Those who institute a clean-up may produce one-time sizeable results while an on-going process will add repeated benefits.

Get Outside Help. The infamous ‘unable to see the forest for the trees’ metaphor exists in many financial institutions. To their credit, the vast majority are focused so diligently on serving customers and growing the business that many practices become common or accepted as the norm, despite potentially better ways to manage the business. Enlisting outside support, firms with industry expertise can assist with using the data and identifying overlooked improvement opportunities and providing new ideas leveraging market best practices across multiple organizations.

There is hope for community banks to drive needed revenue growth to bounce back in the customers and communities they serve through new capabilities, services, and commitments. Deeper dives into your data and attention on revenue flows and interest or fee calculations can produce opportunities – leakage unrealized. For those who create the required focus and intensity, the rewards will be many.